Top 5 Common Mistakes Construction Workers Make with Their 401(k) and How to Avoid Them

Assisting a Construction Engineering Firm to Maximize Tax Savings with a Cash Balance Plan

The Role of Financial Advisors in Helping Your Construction Workers Plan for Retirement

How to Handle 401(k) Administration for a Growing Construction Company

Boston Business Journal names Twelve Points a 2025 Best Places to Work company

Using a Deferred Compensation Plan to Help a Construction Firm with Talent Retention

Revamping a 401(k) Plan to Optimize Efficiency and Align with Ownership Transitions

2025 Q1 Market Review

Twelve Points Retirement Advisors Named to NAPA’s List of Nation’s Top DC Advisor Teams 2025

Fourth Quarter 2024 Review

Greg Phillips and Manny Frangiadakis Named to NAPA’s 2025 Aces: Top 100 Retirement Plan Advisors Under 40

Francesca Federico Named One of NAPA’s Top Women of Excellence

Third Quarter 2024 Review

Second Quarter 2024 Review

Francesca Federico C(k)P® AIF® CPFA® CDFA® Joins the Retirement Advisor Council

First Quarter 2024 Review

Twelve Points Retirement Advisors Named to NAPA’s List of Nation’s Top DC Advisor Teams

Francesca Federico Named One of PLANADVISER’s Top Retirement Plan Advisers for 2024

Twelve Points Named #198 on the 2024 Inc. Regionals: Northeast list

Fourth Quarter 2023 Review

Second Quarter 2023 Review

Francesca Federico Named One Of AdvisorHub’s 2023 Top RIAs To Watch

Twelve Points Named To List Of 2022 NAPA Top DC Advisor Teams

Fourth Quarter 2022 Review

Twelve Points Partners With EBS

Second Quarter 2022 Review

First Quarter 2022 Review

Fourth Quarter 2021 Review

Third Quarter 2021 Review

Francesca Federico named one of NAPA’s Top Women Advisors

We are proud to announce that our very own Francesca Federico has been recognized by the National Association of Plan Advisors as one of the Top Women Advisors for 2020. Her talent and efforts earned her the level of “Captain”, one of only 50 to be recognized at this highest designation.

Francesca Federico Receives National Recognition

Twelve Points Retirement Advisors is proud to announce that Co-Founder and Principal, Francesca Federico, has been named to the National Association of Plan Advisors (NAPA) 2018 list of Top Women Advisors in the “All-Star” category. Launched in 2015, the list acknowledges a growing number of women who are making significant contributions to the retirement industry, as well as bringing excellence to the profession.

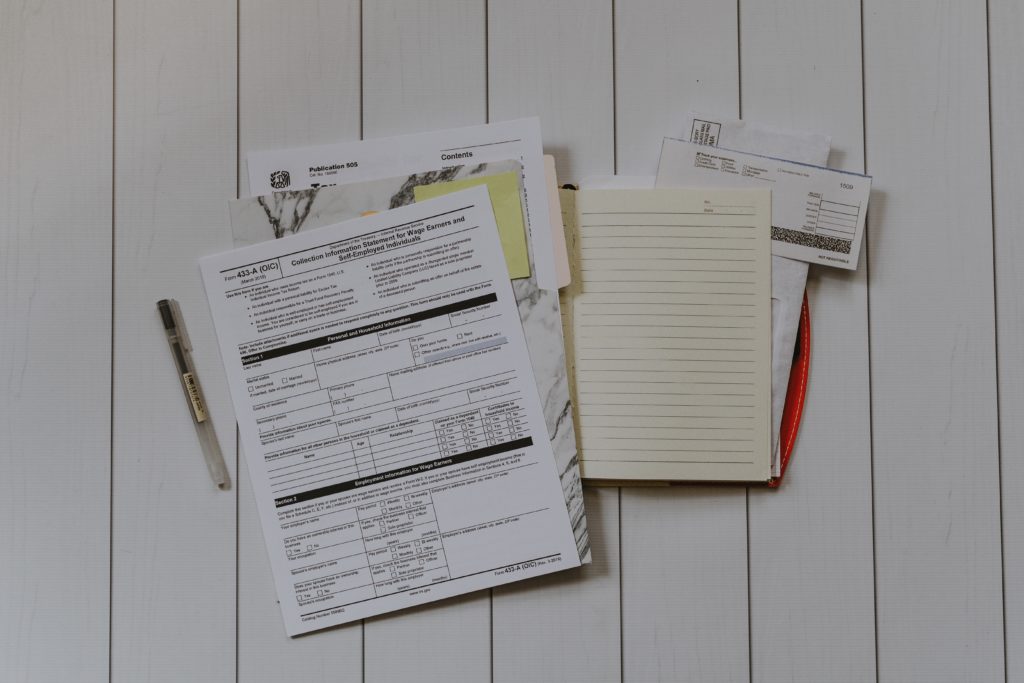

What Retirement Plan Sponsors Need to Know About Fees

A few months ago we met with a construction company with 25 employees to discuss their 401(k) as plan sponsors. During the discussion, they mentioned that their current recordkeeper cost was minimal. We asked for their annual fee disclosure statement and once they sent it over we started to analyze it.

Francesca Federico Achieves CkP Designation

Francesca Federico, Co-Founder and Principal of Twelve Points Retirement Advisors, has been designated as a Certified 401(k) Professional by The Retirement Advisor University in collaboration with the UCLA Anderson School of Management Executive Education.

A Mismanaged 401(k) Could Lead to Litigation

In the last year we have seen a number of cases of mismanaged 401(k) plans going to litigation. This article published by the National Association of Plan Advisors last Monday regarding Pioneer Natural Resources USA, Inc highlights the latest domino to fall.

What is and is Not Working in Today’s 401(k) Plans?

On May 16 we hosted The Plan Sponsor University (TPSU) at Bentley University. 18 people representing 15 companies came to learn the ins and outs and best practices for running their companies’ 401(k) plans. Plans of all sizes were present for the program; ranging from 23 to over 65,000 employees.

The Benefits of Auto Enrollment and Auto Escalation

No, this blog post has nothing to do with cars. It’s about features that retirement plan sponsors can implement to help their employees prepare for retirement at limited, or no, cost to the company. Our most successful retirement plans have both auto enrollment and auto escalation. How do we measure success?

What is one thing I should consider before deciding whether to offer 401(k) plans to my employees?

For many companies — especially startups — deciding whether to offer a retirement plan for employees is often the LAST thing on their to-do list. While many employers want to offer this important benefit as an incentive to recruit and retain great people at their company, they are daunted by the uncertainty of choosing a plan.

Is Your 401(k) Plan Fishy?

Having grown up near the ocean in Massachusetts, I’ve always had respect for hard-working fishermen and women. But I don’t think I’ve ever met anyone who loved the smell of fish. Let’s be honest, it’s not the most pleasant aroma, which is why saying something “smells fishy” has a negative connotation. When something smells fishy, it’s an indication that something is wrong and needs your immediate attention.

University Lawsuits: Will You Be Sued Next?

There has been a recent flurry of university lawsuits because of issues with educational institutions’ retirement plans. Yale, MIT, NYU, Duke, Columbia, Emory, Vanderbilt, John Hopkins and Penn are just some of the universities being sued for allegedly not acting in the best interest of their employees.

Dave Clayman Earns Certified 401(k) Professional Designation

Co-Founder and Principal Dave Clayman was recently awarded the Certified 401(k) Professional designation, or C(k)P®, by The Retirement Advisor University in collaboration with the UCLA Anderson School of Management Executive Education. The C(k)P® designation distinguishes financial professionals who have demonstrated the knowledge and experience to favorably impact the outcome of corporate retirement plans.

Manny Frangiadakis on Tax Planning Advice for Business Owners

In his monthly segment as financial reporter for Radio Entrepreneurs in March, Manny Frangiadakis spoke with program host Jeff Davis about mitigating taxes. Their discussion covered saving, spending and various tax planning strategies for business owners.

DOL: Whatcha Gonna Do When They Come For You…

Growing up in a family business, I learned that you are only as good as the people you surround yourself with. To quote my father Paul Federico, “My employees are my greatest asset. I make sure they know that every day.” Most companies put retirement plans in place to retain and reward their employees, but what they don’t realize is that they need to constantly monitor those plans. If they don’t, not only can it hurt their employees, but it can also hurt them.

Tax Strategies for Entrepreneurs

Manny Frangiadakis’ inaugural segment as the monthly financial reporter for Radio Entrepreneurs took place on February 27th, 2015. He and host Jeff Davis discussed the importance of having a retirement account and strategies for mitigating taxes for business owners. For most business owners, it’s a priority to figure out a financial strategy that benefits their business, their employees, and potentially helps them save money on taxes in the process.

What Are Your Employees REALLY Saying About Your Company’s 401(k)?

On a weekly basis, I talk to myriad people at events, social gatherings and in the process of doing business. Somehow we always end up talking shop. The number one question I get asked is, “What should I do with my 401(k)?” To clarify, I ask, “What do you mean?” Their follow-up question is, “Well, how should I invest it?” To which I respond, “Who is the advisor on your plan? Just ask them.”

Strategies to Reduce Taxes for Business Owners

Businesses, the people who own them, and the industries they constitute, are unique. I think we can all agree that a grocery store operator is going to have different needs and issues than the dentist down the street. However, there are some commonalities among business owners, the most important of which is that they all want to minimize their taxes. So how does one accomplish such a feat? Here are a few tax-reduction tips for business owners:

3 Things Every Company With a 401k Should Ask Its Advisor

Does your company have a 401(k)? Are you the Plan Sponsor? If you answered “yes” to both of these questions, I have one more for you: are you aware of the fiduciary role you are assuming? As a business owner and a 401(k) Plan Sponsor, you have a responsibility to select a high-quality investment advisor for your plan.

Francesca Federico on Gift-Giving & Family Business Succession Planning

In December 2014, Francesca Federico was a featured guest on Small Business Digest Radio. She and host Don Mazzella spoke about her career path, gift-giving advice and succession planning for family-owned businesses.

Tips for Businesses to Get Off to a Great Start in the New Year

It’s that time again, when everyone looks back over the past year and decides what changes they must implement to better their lives. Maybe you are one of the masses flocking to the gym to improve your health this year. Or, maybe your goal is to add more leisure to your daily routine and help lower your level of stress.