Despite the surge of new variants of Covid-19 around the World and the Federal Reserve getting ready to take their foot off the gas, markets largely climbed the “wall of worry” during the fourth quarter. The broad US bond market was down slightly for the quarter, although longer dated Treasury bonds ended the quarter up 3%. Other areas of the fixed income markets such as Preferreds, High Yields and International bonds were +/- 0.5%, in line with the US bond market. Both the S & P 500® and NASDAQ® were up over 11% for the quarter, led by strength in Technology stocks (+17%). Size continued to play a major role as small caps underperformed large caps with the Russell 2000® up 2% and the Russell 1000® up nearly 10% continuing last quarter’s underperformance by small caps. Large cap growth (+9.5%) outperformed large cap value (+7.2%) this quarter but the reverse was seen in both mid-caps and small caps where growth underperformed with value producing positive returns across the capitalization spectrum. Cyclically sensitive stocks such as Industrials, (+9%), Basic Materials (+15%), Energy (+8%) and Consumer Discretionary (+14%) all did well as optimism toward the length and breadth of the economic expansion continued. Interestingly, the best performing sector this quarter was Real Estate at +18%. Precious metals were up (Gold +4%, Silver +5%) with broad Commodities appreciating another 2% during the quarter as the inflation concerns we’ve previously discussed continue to be a major area of focus among investors.

For the year, the S & P 500® was up nearly 29% with the NASDAQ® up about the same at +27% and the Russell 2000 up 15%. The best performing sectors include Energy (+53%), Real Estate (+46%) Financials (+35%) and Technology (+35%), while Utilities and Consumer Staples were up “only” 17% for 2021. The broad fixed income market was down about 2% for the year with long dated Treasuries down about 5% through December 31. International stocks lagged the US with developed markets up about 12% and emerging markets down about 4% as global economic activity remains mixed due to Covid. The commodity index continued to lead, returning nearly 40% this year after last year’s underperformance.

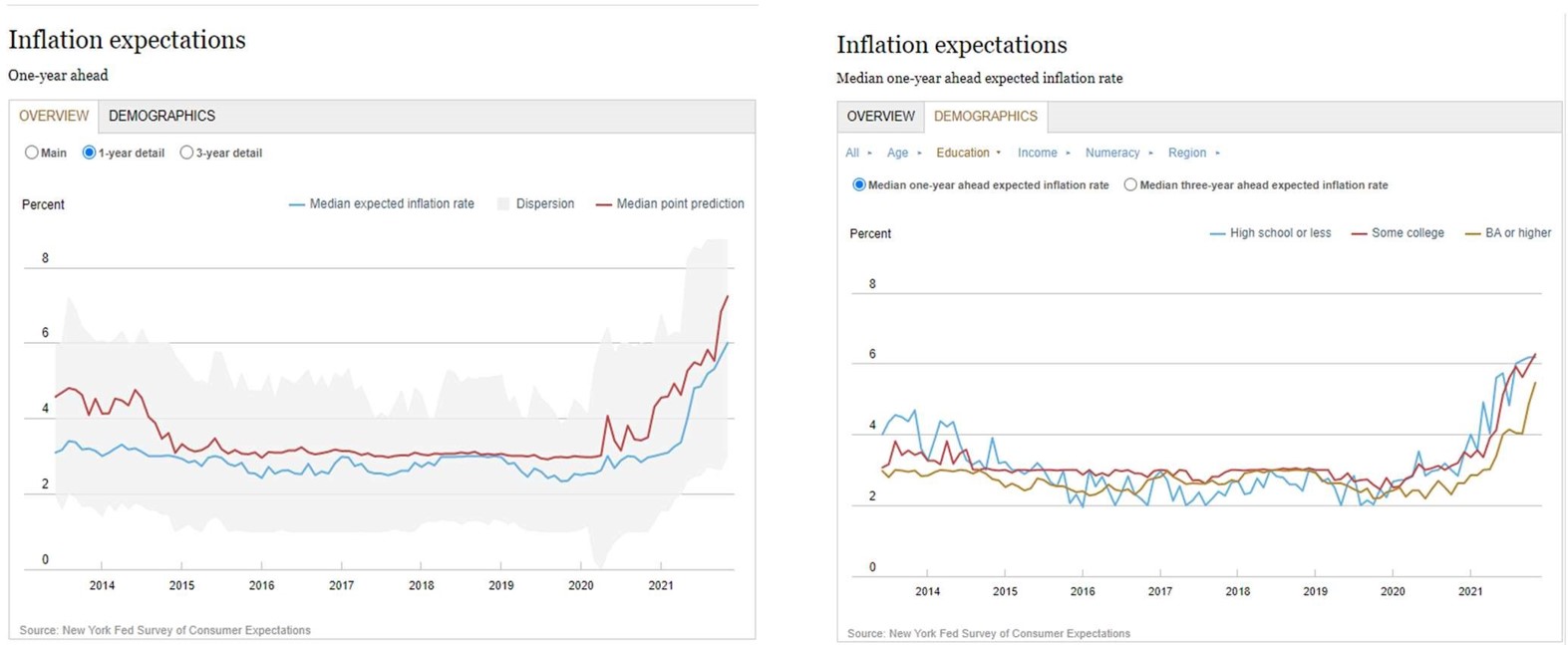

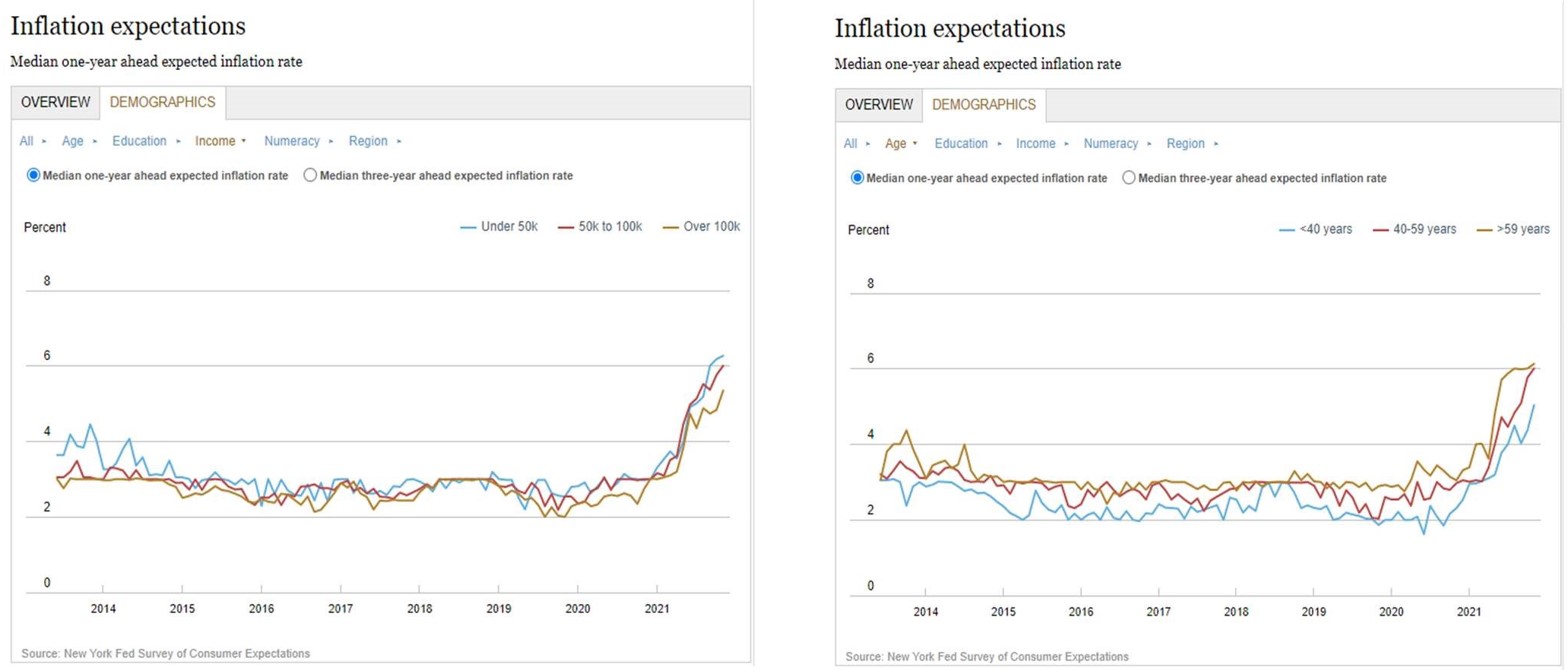

Inflation has been a hot topic of late in both the general and financial press. For the first time in a very long time people have been surprised by a significant pick up in the prices of all sorts of items: from food, to clothing, and to energy, prices have risen dramatically. This is causing concerns about changes in inflation expectations and how that will impact the ability of global central banks to manage their economies. Jeremy Rudd, a researcher at the Federal Reserve, has recently put out a paper that is most provocative. He directs his arguments at an axiomatic idea in economics: that expectations determine inflation. The conventional story is straightforward. When workers expect prices to rise, they demand higher wages. When firms expect costs to rise, they set higher prices. In both cases, inflation becomes a self-fulfilling prophecy. A central banker’s task is to pin down expectations at a low, stable level. If they succeed, they can control inflation. This idea also appears to have been remarkably successful. For the past three decades inflation in the developed world has been quiescent. Whenever it has shot above target, it has, soon enough, fallen back. Expectations are, in the parlance, “well anchored.” Indeed, this is why many economists are sanguine about the current bout of inflation: supply disruptions will eventually pass, and price pressures will ease. It is a comforting thought. Enter Mr. Rudd, the author of more than a dozen papers on inflation over the past two decades. The idea of inflation expectations “rests on extremely shaky foundations,” he writes. First, he says, the theory is flawed. Models of inflation mostly include expectations as a short-term variable (that is, what prices will be in the next month or two). Insofar as expectations matter, though, central bankers and analysts think of them as a longer-term force, an underlying trend impervious to cyclical ups and downs. Empirically, however, this is hard to document. Nevertheless, it is true that the past three decades have seen both subdued inflation and low expectations, however measured. But Mr. Rudd’s contention is that the causality has been misunderstood. It is not that low expectations led to low inflation, but rather that low observed inflation led to low expectations. As he notes, it was only after a recession in the early 1990s, when inflation fell sharply and then stayed low, that expectations were ratcheted down. Mr. Rudd concludes that obsessing over inflation expectations is useless and dangerous. Useless, because it is observed prices that count. Dangerous, because central bankers might grow unjustifiably confident in their powers of mind control. Three important arguments come out of his work. First, central-bank credibility is precious. Second, expectations of inflation are formed by experiences of inflation. And third, in the long run, such expectations probably matter. The aforementioned should help put the following charts from the New York Federal Reserve into perspective:

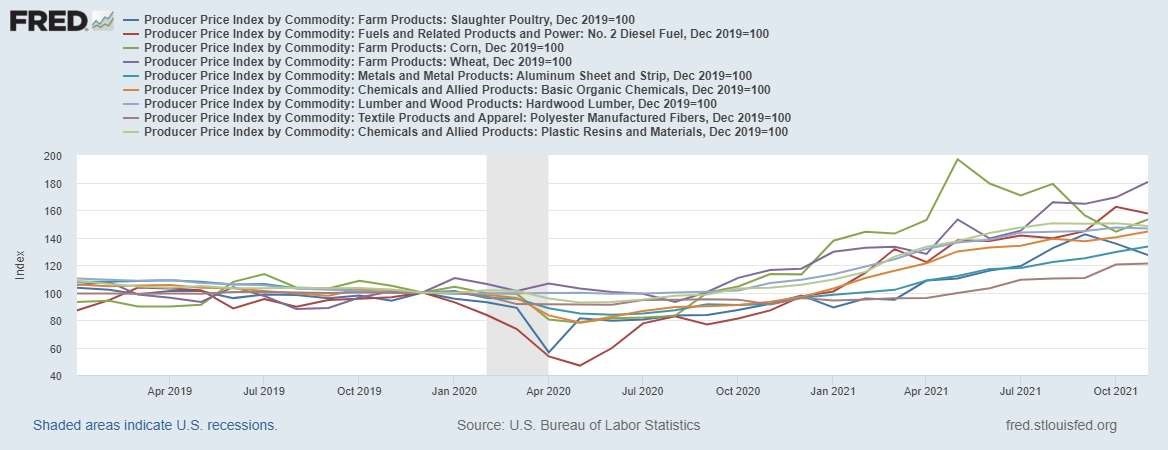

As you can see – the change in inflation expectations cuts across all demographic groups. The Federal Reserve had tried to control the narrative on inflation claiming it was both transitory and the result of comparing the prices to Covid-19 lows but finally had to retire the word “transitory” at their December meeting. The reality is that prices for all sorts of raw materials that go into items that consumers buy everyday are up between 28% and 80% – when compared to prices that existed on December 31, 2019, in other words, pre-Covid. It would appear, at least to this observer, that inflation expectations have become “un-anchored” again after the Federal Reserve spent the 1980’s repairing the damage they caused to the country during the 1970’s.

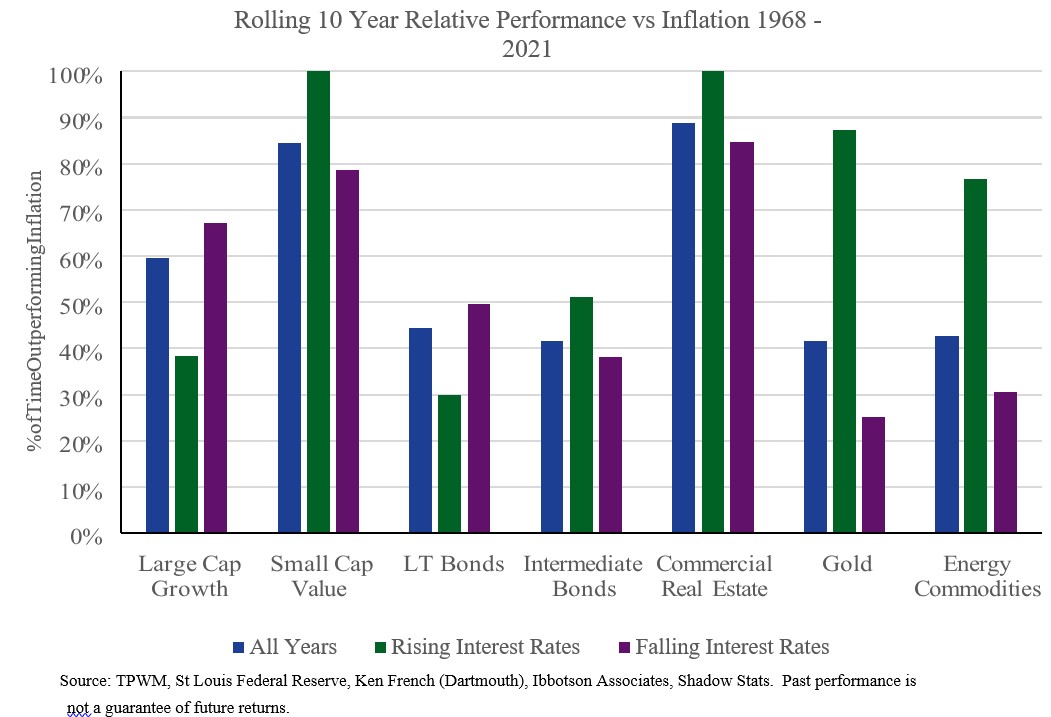

While this is important for a number of reasons, how we are positioning your portfolios is probably the most important to you at this point. The chart below represents research we have done recently to help us in this regard.

This chart has driven most of the asset allocations decisions we’ve made over the last two quarters with the green bars representing the percentage of time various asset classes outperform inflation. That is, shifting your portfolios toward smaller cap value stocks, reducing the duration (interest rate sensitivity) of the fixed income portion of your portfolio, and adding to positions in commodity related securities and real estate. All these changes are in an effort to increase the probability that your portfolios will outperform inflation and protect your purchasing power.

We at Twelve Points Wealth hope you and your family had a happy and healthy holiday season and wish you the best in the New Year. Please call or email if you have any questions.

![]()

Steve Bruno, CFA

Chief Investment Officer

January 1, 2022

Disclaimer: Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results.

Returns and data cited above are from various sources including Factset, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve and Y Charts, Inc.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

Twelve Points Wealth Management, LLC is an investment adviser located in Concord, Massachusetts. Twelve Points Wealth Management, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Twelve Points Wealth Management, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.